How cases arise will rarely determine whether or not we will support them.

Your expertise, and the type of investment you seek, are also important considerations for us. Some examples of our areas of specialism are set out below, and our information sheets highlight what we look for in each type of case. We fund all kinds of civil disputes except personal injury and divorce.

We operate in several jurisdictions, whether funding one case, a portfolio of cases, or a law firm. We support cases whether they are resolved through arbitration or litigation, and whether they are brought by one claimant or many.

Arbitration

Harbour funds parties from many industry sectors when they seek to resolve disputes through commercial arbitration or investor-state arbitration.

Competition

Harbour can fund businesses, consumers, or even States who wish to challenge anti-competitive behaviour. We are experienced in supporting follow-on claims and stand-alone actions.

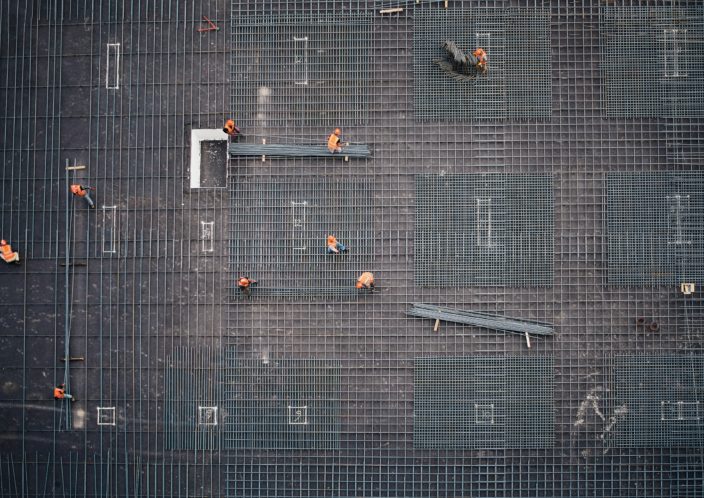

Construction

In an industry where cashflow can be tight, Harbour’s funds and experienced team help parties resolve expensive and technical disputes.

Employment

Employees often face an uphill struggle when they seek to challenge the actions of their employers. Learn how Harbour helps them level the playing field.

Enforcement and Asset Recovery

Our long experience means we know securing a judgment on liability and quantum is only half the story. Learn how we can help with funding for enforcement and asset recovery proceedings.

Financial services

The business of financial institutions often gives rise to disputes over the mis-selling of products, or the mismanagement of funds. Harbour helps individuals and groups of claimants seek redress.

Fraud

The financial loss which can flow from fraud is often the very thing which prevents victims from seeking redress. Harbour funds fraud actions, as well as ancillary proceedings to ensure assets can be recovered.

General commercial

Where commercial transactions do not turn out as planned, litigation or arbitration may be a necessary tool. Harbour helps reduce the cost and risk of dispute resolution, freeing up your funds for investment in other areas of your business.

Group and class actions

Harbour is one of the world’s leading funders of group and class actions. We fund claims involving securities, shareholders, data breaches, consumer claims, mass torts, competition disputes, and more. We know where the risks arise, and what obstacles you are likely to face.

Insolvency

Creditors of insolvent entities may understandably be reluctant to spend money on pursuing claims. Harbour’s funds can help claimants and insolvency practitioners maximise the value of any claims in an insolvent estate.

Intellectual Property

Inventors and other intellectual property owners need to be alert to those who infringe their rights. Harbour can help them seek compensation for their losses.

Product liability

Defective products can cause untold damage to purchasers, users, and third-parties. Learn how Harbour can help them seek compensation for such damage.

Professional negligence

Harbour supports those who suffer loss or damage as a result of the negligence of their professional advisers. Learn how we help shareholders, creditors, insolvency practitioners and others to seek redress.

Shareholder

When shareholders – either individuals or groups – disagree with company managers on issues of ownership, control, profit distribution, or disclosure of key information, then losses can arise. Harbour has extensive experience in supporting shareholders in bringing claims to recover those losses.

Trusts

Harbour can help support disputes arising from a trustee’s mismanagement of a trust, or their improper distribution of trust assets, or a failure of proper accounting.